We are value investors focused on multifamily assets with asymmetric risk-return profiles.

Guided by operators experienced in acquisitions & asset management.

High growth metros in the Southeast, backed by data & local insight.

Clear communication, aligned interests, & visibility into decision-making.

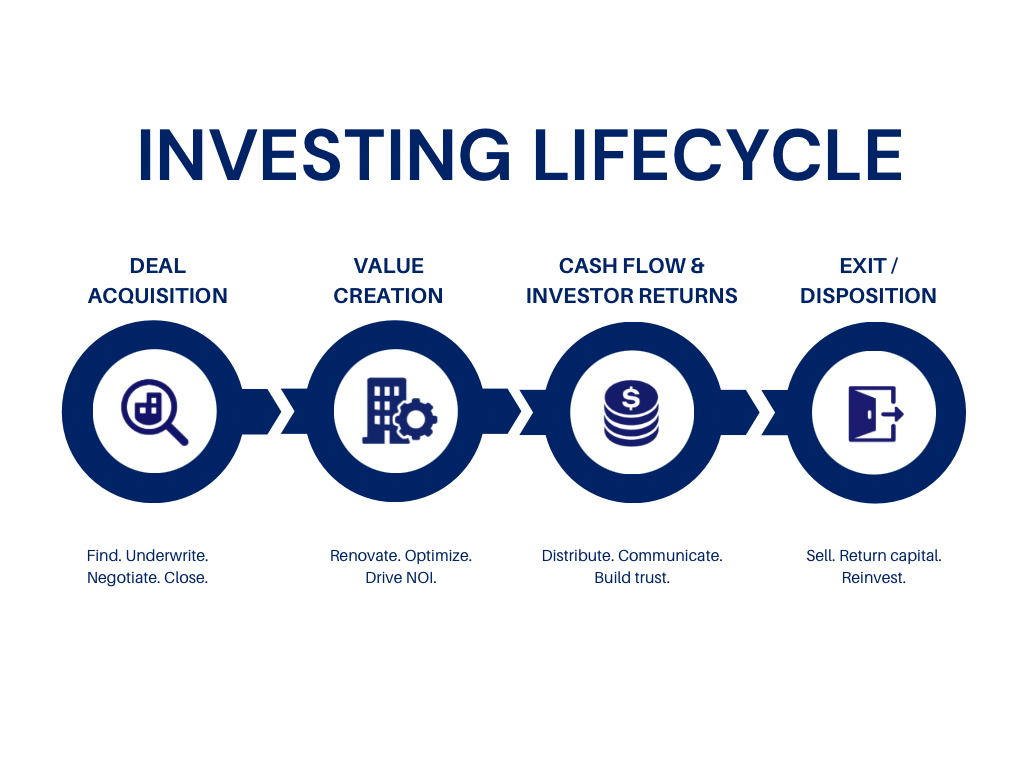

Our focus is on underperforming, and/or distressed Multifamily assets across high-growth Southeast markets, delivering risk-adjusted returns. We are value investors with a philosophy that begins with managing downside at the highest level – which is our top priority alongside strong returns. We are equally committed to investor transparency.

Value investing allows us focus only on assets the market has deemed undervalued and acquire them at a meaningful discount.

Identify bottlenecks early & execute to drive performance across every asset.

Each acquisition is backed by deep analysis, conservative underwriting, and clear exit strategies.

Our strategy is shaped by operators & advisors with decades of real-world multifamily experience.

Every deal is modeled with downside in mind—not just best case scenarios.

We prioritize durable returns over short-term wins.

From underwriting to exit, our decisions are built around transparency, shared success, and strategic execution.